PART III B – Monetary Ride in the Great Unknown

Recap-

In the previous part, we (we mean Bimal) discussed the monetary aspects of life in the US. Part III A, ‘Monetary Ride in the Great Unknown,’ was all about how to earn some extra cash as a student, how to open a bank account in America, get an SSN, become financially stable, and buy a car (since that is one of the top necessities in America).

But there is more to your financial life than opening a bank account and choosing a preferred mode of transportation. It also involves making plans for the future, such as buying a house (or renting one, as the case may be) or even getting insurance (because, trust us when we say, the medical bills in America are damn costly!). Luckily for you, Part B of the ‘Monetary Ride in the Great Unknown’ deals with all these subjects.

So fasten your seatbelts, grab a notepad and pen, and read further as Bimal talks about his own experience with all things money and immigration and also gives advice on what to do and what not to do!

Make a House a Home

Every person wishes to own a house. No matter when (obviously wanting it to happen as soon as possible), where (we all have the dream location, but things don’t always go according to our plans and dreams), and how (we know the size, interior, and even the kind of plant we want by heart), everybody wishes to have a place which has their own nameplate. This is the exact kind of dream an Indian immigrant in America also has. But the process of buying a house there is a bit different than the one we have in India.

Bimal himself is in the process of buying a house, so he knows and understands this process inside out. Now, obviously, before buying a house, you should be aware of your finances. The amount of money you would require to purchase a property is huge. Even the costs that come after you have bought it would be equally high. So, to take care of your expenses, you must be active in your income, expenditure, financial management, and the risks involved. Luckily, Bimal is here to explain the process.

He says finding the right house is a process that requires good searching skills, considering the high interest rate and the cost of the houses. To balance out the equation in this extremely demanding market, Bimal advices that you must maintain a truce between the interest you are willing to pay, the down payment you can afford, the amount of loan you can take, the money you have as your personal savings and the kind of house you are looking to buy. You also have the choice between choosing a house that is move-in ready or one that requires work.

He says it is necessary to look at all these factors because the amount that would be involved is not small. In fact, it can be as high as $20,000 – $30,000. And if this amount is on a loan, you would also be paying interest on it. Thus, you must be very sure about each aspect before buying a house.

Bimal further adds that if you buy a house that requires some construction, you would have to decide if you have the bandwidth for such expenses. As he had mentioned before, these expenses might occur from your credit card, which might incur some interest as well, so the amount of money you can afford plays a big role. Be sure of that.

“Even after you buy a house, you’ll still have to make some compromises on it.”

The cost of a house depends on the state in which you decide to reside. Since Bimal is settled in Atlanta, he shares his experience of buying a house there. He says, “Depending on the area, the cost might vary, but you can buy a decent house for $300,000.” Bimal further adds that “even after you buy a house, you’ll still have to make some compromises on it.” In fact, if you’re buying a newly constructed house, many factors will play into that.

However, Bimal mentions that “$300,000 is a decent amount if you want to live” in a three-bedroom house. He adds that this house can also have enough porch space to allow you to throw a barbecue party, have a decent-sized kitchen, etc. So, with $300,000, you can buy a good house in Atlanta because Bimal mentioned that it is still very affordable. It’s not as affordable as it was 7-8 years ago because of immigration. Atlanta has had a population increase of 1 million in just the last seven years. That’s a record in itself for any city. And because of this influx of population, housing has also become expensive.

Rentals or Owners?

It might be difficult to decide if renting a place is more profitable and less expensive than buying a house. Various experts have also pointed out that renting a place their entire lifetime might actually prove to be economical. But we Indians could never spend our whole lives in rentals, right? However, things and decisions change a bit when money comes into the picture. This is because buying a house is not very easy in the present economy. But instead of the “YouTube experts,” let’s hear it from an actual immigrant.

Bimal says if you are single and someone who loves to change places, renting a house/apartment would be a better alternative. He explains through an example that “if you are a consultant moving from cities to cities, country to country, you’re not in a stable life right now. So renting an apartment/house would be a better option as you wouldn’t have to worry about the apartment’s maintenance and other things.” This is because the home/apartment owner you rent the place from will manage everything. You don’t have to do much.

However, you must live by the property owner’s rules when renting a property. You can’t put holes in the walls of the rented house because you’ll have to pay for it at the end through your deposit. Simply put, it’s their property; you are just living there. So, a rental might be better only if you are travelling often.

But things change when you decide to buy a house. You will have to decide whether you want to have equity or not and consider whether you can manage the equity as well. This is because, in America, nothing is truly yours.

Bimal mentions that financial experts are absolutely right about one thing – ‘owning a house is a commitment.’ This is because the ownership comes with a lot of other expenses. So, if you’re not paying a 20% down payment, you’ll have to pay mortgage insurance that’s $200 a month, assuming the house costs $300,000, and on top of that, there are property taxes.

Now, if you are a parent with school-going kids, you must also consider that. In the US, enrolling your kid in a public school closest to your house is mandatory. So, the quality of schools near the property also defines property values in the United States.

Your property taxes, home insurance, interest rates, and maintenance are also combined with the other aforementioned expenses. Houses in America are not built to last a hundred years like in India. You’ll have to do constant maintenance to bring your house up to speed with the latest infrastructure. This means changing the walls periodically, redoing your bathroom every ten years, changing your HVAC every 15 years, and so on.

If you decide to change your flooring every ten years, there might be certain expenses. And if you plan to live longer in that house, you’ll have to pour in even more money. However, you can earn all of that back in 10 years when you will be able to sell your house for at least 80% more than what you bought it for. So, buying a house may not make sense if you’re traveling and working as a consultant living in different cities or companies. But, if you buy a house and then rent it to someone else, the house might work as an investment and would be very profitable. And this might surprise you, but many people have done it before!

Buying a property for yourself comes with a commitment. So you can’t buy a house and just sell it off after two years as you’ll lose a lot of money that way. You have to stay in that house for a certain time to make money because the closing cost alone is $11,000 – $12,000. After the mortgage, you have to pay $11,000 – $12,000 just to get the paperwork done, not to mention the maintenance work you did in the house to make yourself comfortable. Thus, Bimal agrees that the financial experts are right about not owning a house and instead renting one.

Bimal concludes by saying that buying or renting a house depends on what stage of your life you are at. “If you’re living a single nomad life, renting is right.” Bimal also mentions that he knows “a few people who keep travelling from city to city, and they have their stuff in storage boxes in storage banks.” He adds that “they pay $100 monthly and put all their stuff” in storage banks. Then, “they take a car and move around the States in different places.” So, in this regard, renting makes perfect sense. Even if you are someone who has limited money, renting makes sense.

“Before (the age of) 35, if you have a decent job and a stable life, buying a house equity definitely will work.”

Health and Insurance

Immigrants are not eligible for Obamacare (or “Medicaid,” if you go for a Governement Health Insurance program). This is because Medicaid is meant only for American citizens. So, immigrants are supposed to have their own insurance. But Bimal is certain there are several ways to go about the insurance. The first is through your college. Since health insurance is mandatory for any international immigrant in the F1 H1 Visa category, your college will provide some type of it. They will give you a very comprehensive plan for a student that covers a wide variety of coverage for you. However, that will set you back, as the college will add it to the tuition like they did for Bimal for the first semester.

This college-provided insurance adds about $1,100 – $1,200 per semester. Since Bimal had three of these, costing him a lot of money, he went with the cheapest option available in the market for international students: ISO insurance. It was only $ 300 a year compared to $ 3,000 that it would have cost through college. And since the amount was only $300, he decided to try to be healthy throughout the year.

Initially, Bimal signed up for the college-provided insurance. He believed that was the right thing to do. Our dear immigrant recalls that, when he got there, many people had already signed up for insurance because they had some friends in America, and all of them suggested going with the cheapest insurance. Thus, Bimal says, “If you have any problems that you think might come up (and unfortunate circumstances do come up sometimes), you must make a judgment call. Either you can save money, or you can be assured of your health”.

Bimal mentions that ISO doesn’t get you the coverage you need. In fact, you’ll rack up a huge bill if you end up in a hospital. The hospital bill could be as high as your tuition fees because healthcare is extremely expensive in America. You are also legally required to show that you are insured for the entire year. So you definitely NEED to get insurance. Cheap insurance wouldn’t cover much, but it can be used as a scapegoat until you find a job with an employer who provides good insurance. So you might as well save some money while in the process.

While Bimal went for the cheapest insurance, he mentions that the decision finally rests on the person (or, in this case, on you). Bimal was in good health back in the day, so he took the risk. And while he might have gotten lucky, he recalls how his acquaintances weren’t. One of Bimal’s acquaintances racked up a bill of up to $15,000 in the hospital. That person had no job, so the state government waived off much of the bill’s amount.

But that wouldn’t have been the case if Bimal’s acquaintance had found a job. If he were employed, the person wouldn’t have been able to get his first paycheck. In fact, if he got that same medical bill a month later, he would have had to pay every single dime off. To put it into perspective, if you end up with a $20,000 medical bill, it’s the equivalent of half of your tuition. This is how expensive the American healthcare system is. So our NRI expert (Bimal) says it’s a judgment call based on your current health condition and your confidence in keeping yourself fit throughout the year.

What we discussed until now was health insurance during college. However, things change when you get an actual job. Since Bimal is also a working professional and has been one for some years now, he has some tips and tricks to share on how to go about health insurance now. (Bimal has a stable job and a very good health insurance plan!).

Bimal says he puts a $100 into his HSA (Health Savings Account). His HSA pays off handsomely because his company pays one part of it, and he pays the other, accumulating a much larger amount. This structure of health insurance allows him to get whatever he might need with regard to his medical expenses. Something to note here is that this is tax-free money. If you’re paying 20-30 percent taxes, that’s a 30 percent benefit because of your HSA. So that’s a win-win.

Our dear NRI mentions that you can also buy cosmetics with the HSA account. But you can only buy the tax-free ones. Bimal’s advice about the HSA is, “Starting 401(k) and starting HSA has to be your first priority because that’s tax saving.” So the more tax you save, the lower bracket of the federal tax bracket and tax slab you are in. These lower taxes will save you a lot of money.

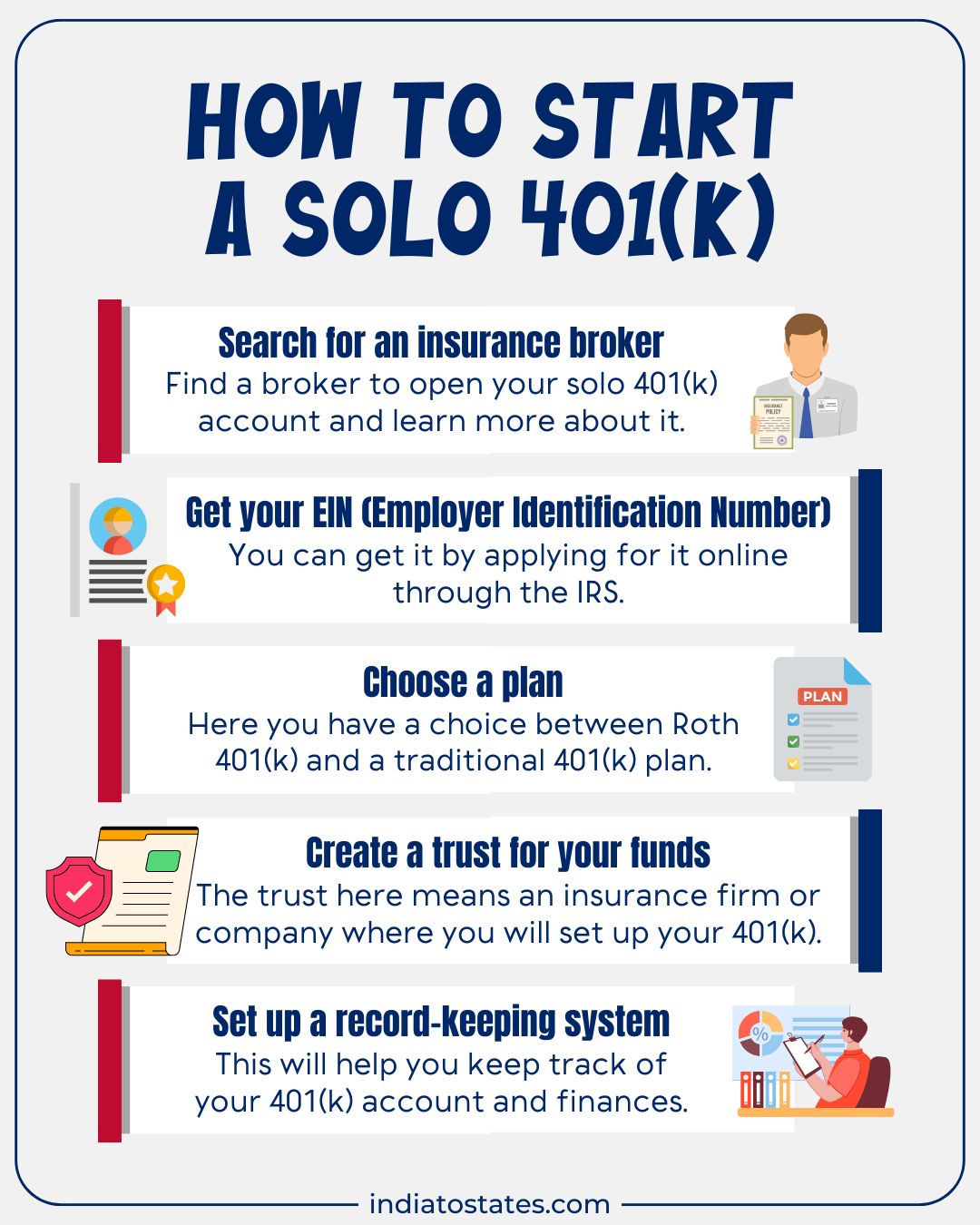

While you might not have started your own business yet, who has seen the future? Now, every working individual needs to plan for their retirement. So why should a small-business owner or a self-employed person be any different?

Luckily, you can set up a 401(k) account in these cases as well. In this regard, the 401(k) account would be called a Solo 401(k). And since we are here to help, we have also compiled a list of steps for setting up a Solo 401(k) account.

Now, if you have any more money left after all these insurance, taxes, and house-buying shenanigans, there are many other investment options, like personal investments – mutual funds or an ETF. You can explore that idea when you get to America and start earning decently.

Advisably True

Bimal says one should start investing as soon as one lands a stable job. Naturally, he did it right off the bat (following his own advice). His friends started seven years later, and now they regret this delayed start. They were too focused on the short-term goal of “trying to live a happy life” and “not thinking about their future.”

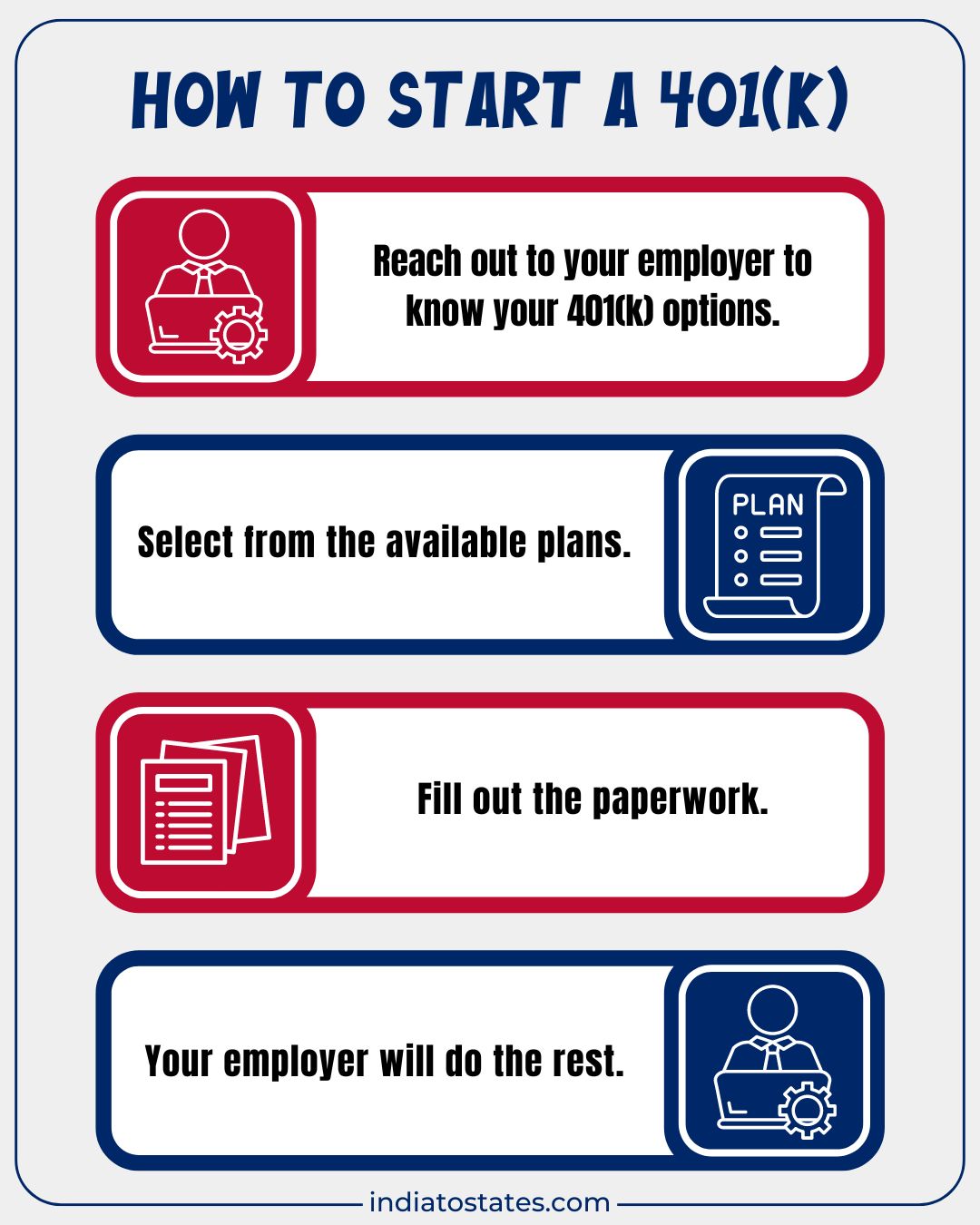

As Bimal explains, a 401(k) is not about thinking about just the future but also your present. Right now, the amount of money you are saving is not much. But you will save 23% additional money in your 401(k) account. This is because your company also pays 3% of your insurance amount. They match your amount by 3%. However, the company won’t do that till you put in 6%. So, if you don’t save for your own retirement, you are leaving money on the table that the company offers you. Simply put, there is an incentive to save, and you should cash in on it.

Conclusion

Wow!

There were some heavy words used. But nevertheless, they were all meant to help you with your finances. Because let’s be honest, how many of us are actually financially sound? You need to be conscious of your finances in a country with such a vibrant economy that is so different from India’s. Considering America’s medical and financial requirements, it is healthy to learn about them all while you are still in India. Wrap your head around the process before actually starting it so that you make the least mistakes.

Now, enough of the Monetary Ride in the Jungle. We will take your journey closer to the last step. PART IV – The Great Cultural Jungle will discuss cultural and social differences in America and how to cope with them. Till then, au revoir!